2022 Review of TCSPs AMLR Compliance – Sanctions Screening

Trust and Corporate Service Providers (TCSPs) play a crucial role in the global financial services industry. As gatekeepers, TCSPs are in a prime position to help prevent the misuse of legal entities and arrangements by ensuring their clients are not subject to or attempting to bypass targeted financial sanctions (TFS). TFS are restrictions aimed at limiting access to financial services and markets for persons or entities under sanction. These sanctions are a cornerstone of efforts to prevent financial crime worldwide.

In response to the intensified sanctions imposed on Russia in 2022, there has been an expansion of TFS, including sanctions related to trustee services provided to designated persons. The HM Treasury's Office of Financial Sanctions Implementation (OFSI) has issued multiple designations that apply to Overseas Territories, including the Cayman Islands, mandating compliance with TFS obligations. Therefore, Financial Service Providers (FSPs), particularly TCSPs, must have robust systems in place to ensure they are not engaging in transactions with designated individuals or entities.

In 2022, the Cayman Monetary Regulatory Authority International ("Cmrai") released a report, "2021 Review of TCSPs Compliance with AMLRs – Sanctions Screening Policies and Procedures", which detailed its assessment of TCSPs' adherence to TFS obligations. This circular provides an update, highlighting deficiencies identified during the 2022 reviews of 23 TCSPs, comparing them to the findings from 2021. The scope and methodology are provided in Annex 1.

All FSPs, including TCSPs, are urged to review their TFS compliance frameworks to ensure that screening systems and controls meet regulatory requirements under the Anti-Money Laundering Regulations (AMLRs) and the AML Guidance Notes.

Failure to comply with TFS regulations constitutes a serious offense under Cayman Islands law. While prosecution and investigations fall under other authorities' remit, the Authority can impose restrictions or take enforcement actions if regulated entities fail to implement adequate systems to meet TFS obligations.

Executive Summary of the 2022 Review

The Authority has observed improvements in TCSPs’ compliance with TFS requirements since the 2021 inspections, noting substantial progress in applying TFS screening measures within AML/CFT/CPF frameworks. Key highlights include:

- TFS screening at client onboarding: In 2022, 78% of the TCSPs reviewed had adequate policies for TFS screening during client onboarding, up from 63% in 2021.

- Ongoing monitoring and TFS screening: In 2022, 91% of TCSPs had adequate policies for ongoing TFS monitoring, compared to 89% in 2021.

- Effectiveness of policy implementation: 30% of the TCSPs inspected in 2022 effectively implemented their TFS policies across all client files, compared to 26% in 2021. However, 70% had at least one file with deficiencies.

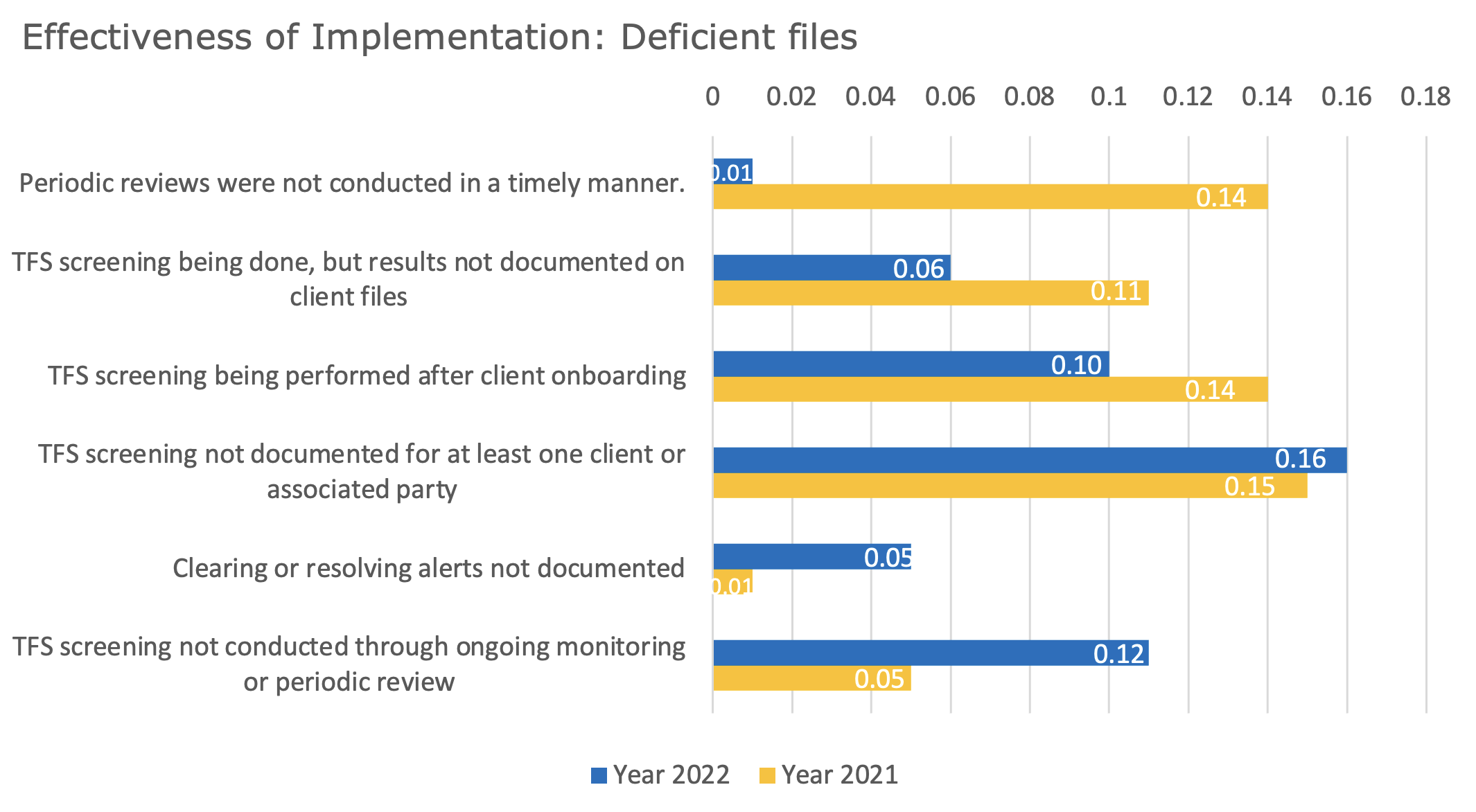

The table below shows improvements in TFS implementation from 2021 to 2022:

- Timeliness of periodic reviews: In 2022, only 1% of files reviewed were late in conducting periodic reviews, a significant improvement from 14% in 2021.

- Documentation of TFS screening results: 6% of files in 2022 lacked documentation of screening results, compared to 11% in 2021.

- TFS screening at client onboarding: 10% of client files reviewed showed instances where screening was conducted after the business relationship was established, compared to 14% in 2021.

Despite these positive developments, some areas still require improvement:

- Screening not documented for at least one client or associated party: 16% of files lacked documented screening of clients or their associated parties, up from 15% in 2021.

- Alerts not properly resolved: 5% of files lacked documentation on how alerts from screening systems were resolved, compared to 1% in 2021.

- Ongoing monitoring: 12% of files revealed that TCSPs did not screen clients during ongoing monitoring, up from 5% in 2021.

2022 Findings: Implementation of AML/CFT/CPF and TFS Policies and Procedures

TFS Screening at Onboarding – Policies and Procedures

In 2022, 78% of TCSPs had adequate policies for screening at onboarding. However, 22% lacked clear provisions for screening clients and relevant parties against TFS lists, tracking TFS updates, and managing positive matches or asset freezing obligations.

Ongoing Monitoring – Policies and Procedures

91% of TCSPs inspected had sufficient policies for ongoing monitoring of clients and transactions for TFS compliance, in line with AMLR requirements. However, 9% failed to fully outline procedures for monitoring clients and associated parties against TFS lists during periodic reviews.

Conclusion and Recommendations

While most TCSPs have improved their TFS compliance, further efforts are needed to enhance the effectiveness of ongoing monitoring policies. The Authority expects all TCSPs to address the deficiencies outlined in this circular, ensuring their TFS frameworks are compliant with AMLRs and other relevant legislation.

TCSPs are reminded to document screening results in client files, take necessary steps when positive matches are found, and ensure staff receive adequate TFS-related training. The Authority will continue to monitor compliance through inspections and remedial actions where necessary.

Annex 1 - Scope and Methodology

This circular is based on inspections of 23 TCSPs in 2022, covering 529 client files. The percentages in this summary reflect the findings from these inspections.

The Authority assessed compliance with AMLRs, focusing on key regulatory provisions such as:

- Regulation 5(a)(v): Systems to identify risks related to persons, countries, and activities, including checks against TFS lists.

- Regulation 5(a)(viiia): Procedures for ongoing monitoring and identification of assets subject to TFS.

- Regulation 5(a)(viiib): Procedures ensuring compliance with TFS obligations.

Sign up for our E-alerts

Be the first to know about releases and industry news and insights.